MBA graduates continue to be drawn to finance jobs due to the lucrative compensation packages, the chance to work on high-profile deals at investment banks, and the opportunity to invest in the next billion-dollar company at a venture capital or private equity firm. As we will see below regarding the MBA Class of 2022, the top MBA programs really deliver on finance industry placement and can accelerate finance careers. In particular, M7 business schools dominate in the buy-side job placements for venture capital, private equity, and investment management.

In this analysis, we review MBA Class of 2022 graduates’ job acceptances in key finance industry categories such as investment banking (IB), investment management (IM), private equity (PE), venture capital (VC), and other finance industry jobs.1

Job Placement in the Finance Industry for the MBA Class of 2022

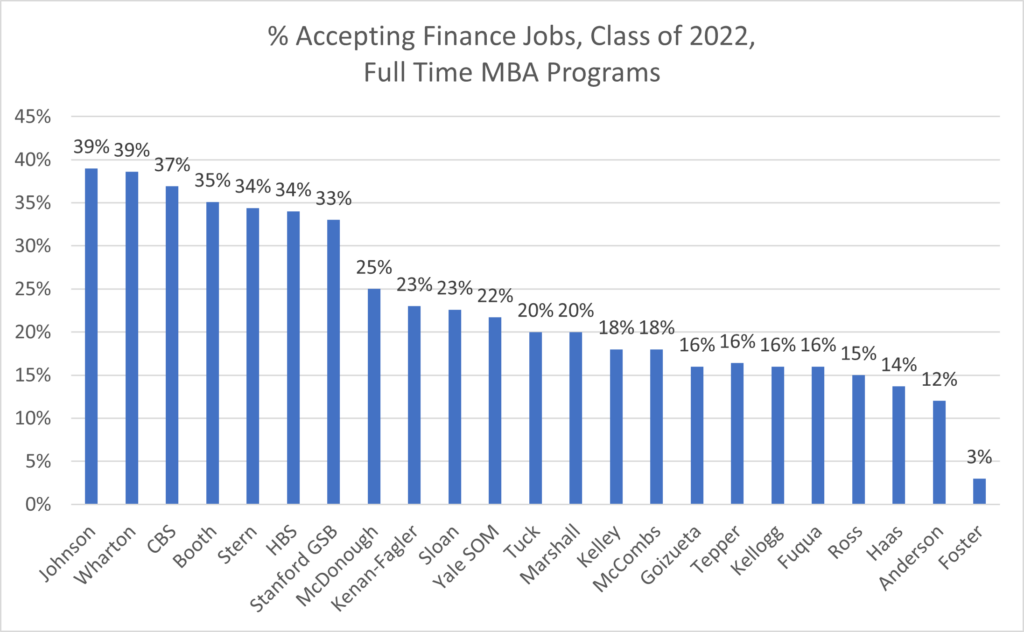

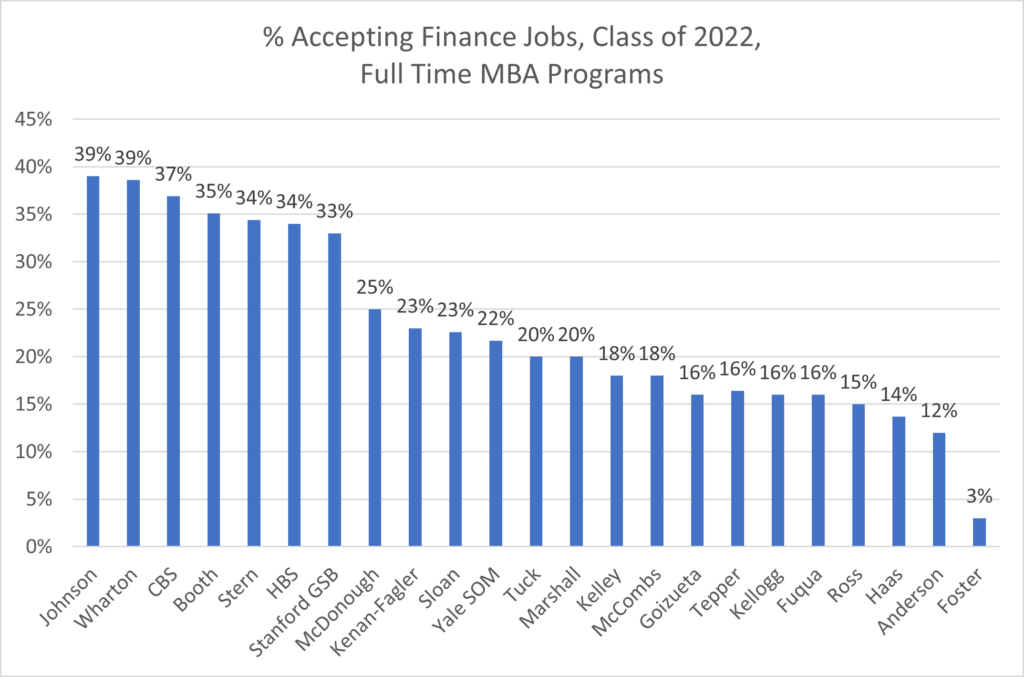

All of the top MBA programs provide good opportunities for their MBA graduates to explore a finance industry career. You can see this in the following chart, which highlights the percentage of Class of 2022 full-time MBA graduates who accepted a finance industry job:

These 23 MBA programs fall into four groups. First, there are seven business schools (Johnson, Wharton, CBS, Booth, Stern, HBS and Stanford) where finance jobs represent over 30% of jobs accepted by recent MBA graduates. There is another group of six MBA programs (McDonough, Kenan-Flagler, Sloan, Yale SOM, Tuck and Marshall) that place 20-25% of graduates into finance jobs. Next, there are nine schools (Kelley, McCombs, Goizueta, Kellogg, Fuqua, Tepper, Ross, Haas and Anderson) that place 12%-18% of graduates into finance jobs. In the final category is Foster which only has 3% of its Class of 2022 graduates accepting finance industry jobs.

While all of these programs send graduates into the finance industry, there are some interesting trends in terms of which schools have competitive advantages in helping its graduates receive buy-side vs. sell-side finance jobs offers.

M7 Schools Dominate Buy-Side Job Placement in Private Equity, Venture Capital and Investment Management

While many business schools can help their MBA graduates pursue a finance industry career, the M7 business schools (HBS, Stanford GSB, Wharton, Booth, Kellogg, CBS, and Sloan) have a strong track record of helping its graduates gain buy-side jobs in investment management, private equity and venture capital. This is apparent in the data that the business schools publish in their employment reports.

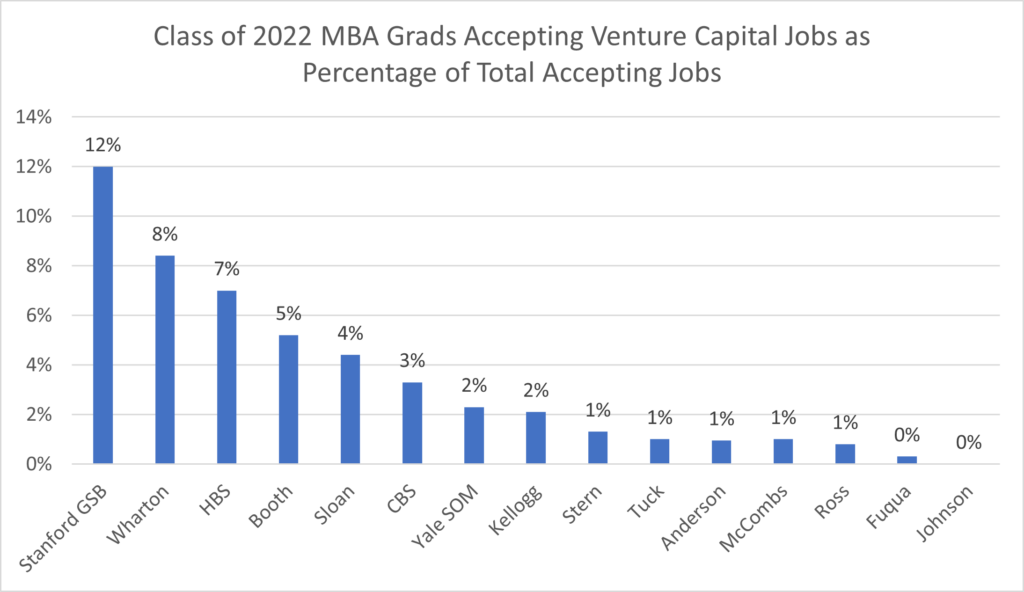

Venture Capital Job Placement

Here is the chart comparing venture capital job placement for the full-time MBA Class of 2022 graduates:

Note: Only 15 of the 23 business schools publish job placement statistics for finance industry subcategories such as venture capital, private equity, investment banking, investment management and diversified finance. Thus, our following analysis is limited to these 15 MBA programs.

Stanford GSB (12%) has the highest percentage of Class of 2022 venture capital job acceptances, followed by Wharton (8%) and HBS (7%). Stanford’s high percentage is likely due to its close proximity and longstanding connections with the venture capital community in Silicon Valley. While HBS has long had deep ties with the venture community, Wharton has surpassed HBS in Class of 2022 venture capital job placements. Next are Booth (5%) and Sloan (4%) who have both increased their VC jobs accepted from 2021 to 2022. CBS (3%), Yale SOM (2%) and Kellogg (2%) round out the 8 MBA programs with the highest venture capital job placement for the Class of 2022.

Because Wharton’s class size is more than twice the size of Stanford GSB’s class size, Wharton actually placed the largest number of Class of 2022 graduates into venture capital jobs (51) compared to HBS (42) and Stanford GSB (34)

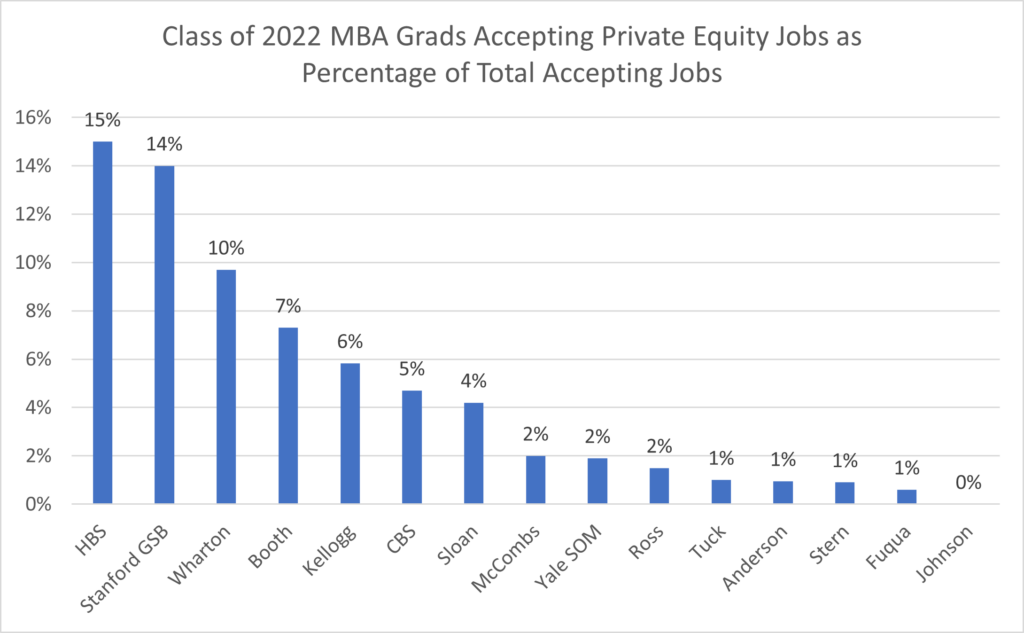

Private Equity Job Placement

Now let’s review private equity job placement for the full-time MBA Class of 2022:

Here, the M7 business schools are the clear leaders in private equity job acceptances: HBS (15%) and Stanford (14%) have the highest percentage of Class of 2022 graduates accepting private equity jobs, followed by Wharton (10%). In terms of the total number of Class of 2022 graduates accepting PE jobs, HBS leads with 90, followed by Wharton (59) and Stanford GSB (40). HBS, Stanford and Wharton have a clear competitive advantage in PE job placement given their deep alumni network in the industry.

Next are Booth (7%), Kellogg (6%), CBS (5%) and Sloan (4%), which have each increased their share of PE jobs from 2021 to 2022. Interestingly, the remaining 8 of these 15 schools have 2% or less PE job placement and 5 of these 8 schools posted a decline in PE job placement from 2021 to 2022.

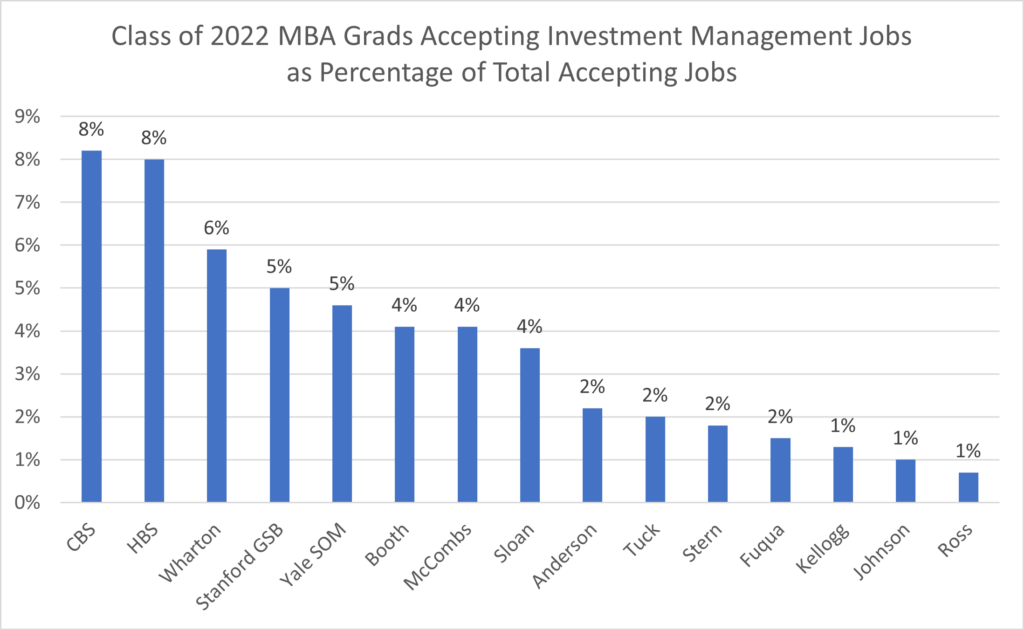

Investment Management Jobs Accepted

Next up we review buy-side investment management jobs accepted for the full-time MBA Class of 2022.

Here CBS (8%) and HBS (8%) lead the pack with investment management job acceptances, followed by Wharton (6%), Stanford (5%) and Yale (5%). CBS is a long-time leader in investment management job placement. Legendary value investor Warren Buffett is a CBS graduate and CBS has a well-regarded value investment program. CBS also benefits from many alumni in the New York based investment management industry. HBS, Wharton and Yale SOM also have strong ties to the investment management industry in Boston and New York. Booth, McCombs and Sloan are next with 4% each for investment management jobs accepted.

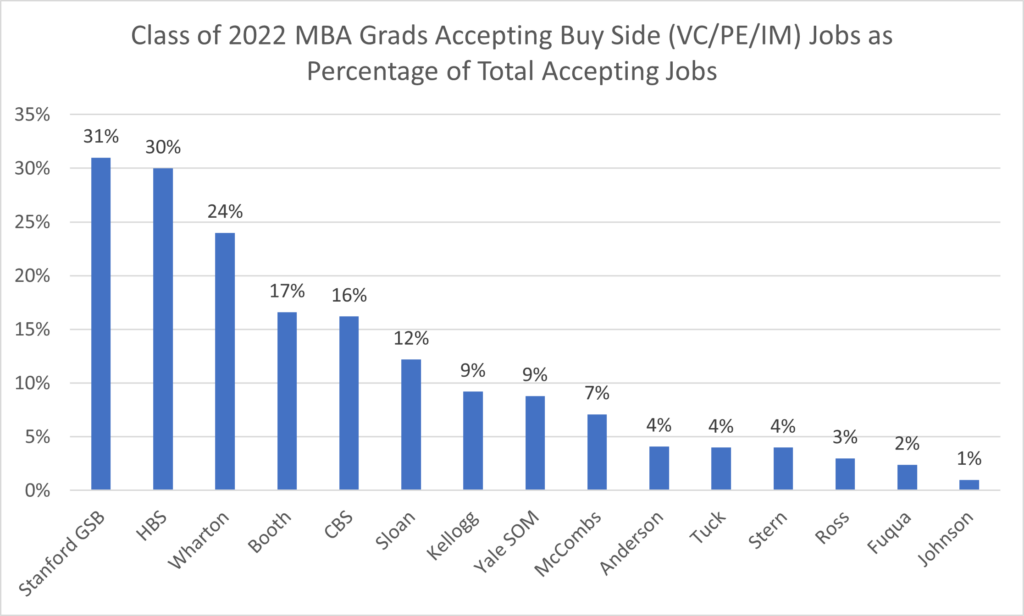

Now, we can add up the total buy-side industry jobs accepted (venture capital, private equity and investment management) for these programs:

Stanford (31%), HBS (30%) and Wharton (24%) lead in the percentage of buy-side job acceptances for the Class of 2022. In fact, it is amazing that 24% – 31% of the jobs accepted by Class of 2022 MBA graduates of these three MBA programs were in prestigious buy-side finance industry jobs. It is a real testament to the Stanford, HBS and Wharton competitive advantage in delivering strong buy-side finance job placement.

Booth (17%) and CBS (16%) are next on buy-side job placement, with Booth placing more graduates in PE jobs and CBS placing more graduates in IM jobs. Next are Sloan (12%), Kellogg (9%), Yale (9%) and McCombs (7%). These nine business schools clearly have a strong track record of buy-side finance career placement.

Of course, business schools such as Anderson (4%), Tuck (4%), Stern (4%), Ross (3%), Fuqua (2%) and Johnson (1%) also provide opportunities for students to pursue buy-side jobs, but not in the same numbers as the other nine MBA programs.

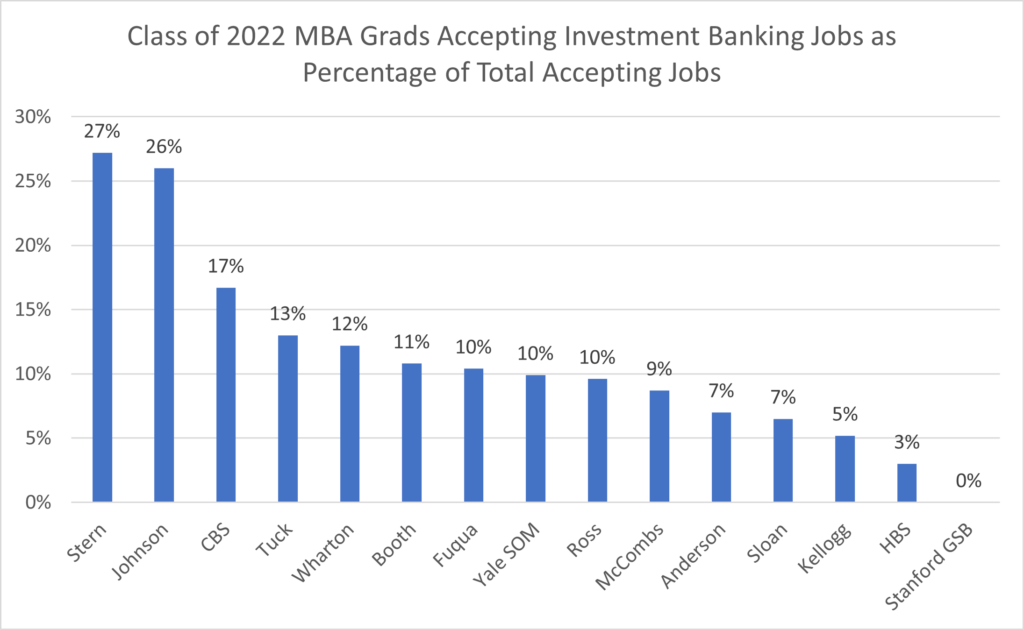

Sell-Side Investment Banking Jobs: Johnson and Stern Have the Highest Percentages

While HBS and Stanford are at the top in terms of buy-side job acceptance, they are at the bottom in terms of sell-side investment banking job acceptances.

The MBA programs with the highest percentage of investment banking jobs accepted were Stern (27%) and Johnson (26%), followed by CBS (17%), Tuck (13%) and Wharton (12%). However, since CBS and Wharton are two of the largest MBA programs with deep ties to Wall Street, they actually placed the most Class of 2022 graduates into investment banking jobs: For example, CBS placed 112 Class of 2022 graduates into investment banking jobs, followed by Wharton (78), Johnson (65), Stern (61) and Booth (58). Meaning, whether you are a career switcher seeking to enter the banking industry or seeking to move up on the sell side, these business schools provide a smooth path into the industry.

It is interesting to see that HBS only sent 3% of the Class of 2022 into investment banking jobs and Stanford GSB sent 0%. Meaning, while finance jobs accepted represent over 30% of jobs accepted at both HBS and Stanford, the HBS and GSB MBA graduates are mostly accepting buy-side finance jobs not sell-side finance jobs. In contrast, while finance jobs accepted among Class of 2022 MBA grads from both Johnson and Stern also represent over 30% of jobs accepted, the majority of these jobs accepted are for sell-side investment banking jobs not buy-side jobs in venture capital, private equity or investment management.

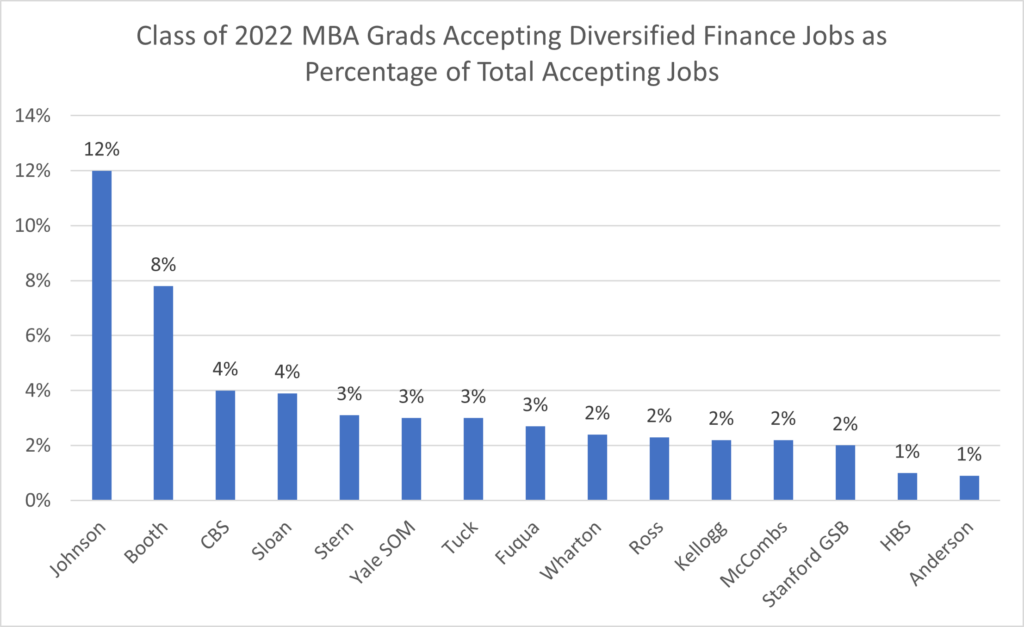

Diversified and Other Finance Jobs

In addition to sell-side or buy-side finance jobs, there is final category of finance jobs that encompasses other areas of finance such as corporate finance, commercial banking and insurance.

Johnson (12%) and Booth (8%) are the leaders in this category. In fact, both schools increased their share of these finance jobs in the last year.

Key Takeaways

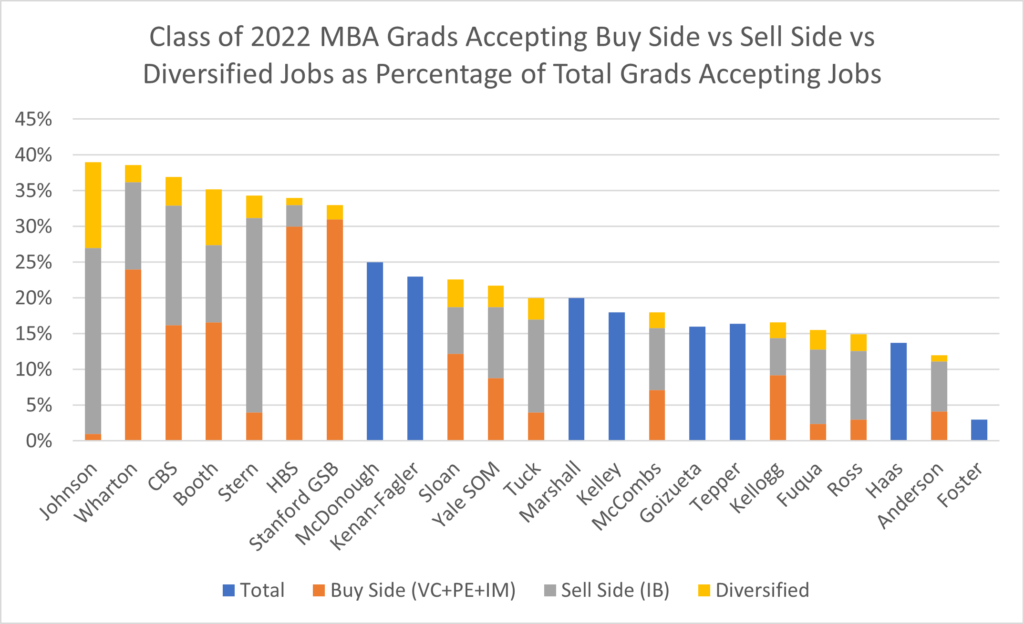

While all of these MBA programs post strong finance industry job acceptances, there is a difference in the types of jobs accepted by graduates of different schools. To summarize this, here is the overall percent of finance jobs accepted for 23 leading MBA programs.

Next, here is a chart showing the buy-side jobs (VC+PE+IM) vs sell-side jobs vs. diversified jobs accepted for 15 MBA programs as well as the eight business schools that do not report their percentage of finance industry jobs accepted by finance industry job subcategories.

There are clearly differences in the types of finance industry jobs that are accepted by graduates of these programs. For instance, most of the finance jobs accepted by HBS, Stanford GSB and Wharton Class of 2022 graduates are in buy-side finance jobs while most of Johnson and Stern Class of 2022 finance jobs accepted are in sell-side investment banking jobs (and diversified finance jobs for Johnson). Other programs like Booth, CBS and Sloan have a more balanced mix of buy-side and sell-side jobs accepted by their Class of 2022 MBA graduates.

- Note: Sell-side firms sell financial products to institutional investors. Buy-side firms are investment firms with capital to invest in financial products. For example, a sell-side investment bank might help broker the sale of a company to a private equity firm. Sell-side firms such as investment banks typically offer formal training programs to new employees. This makes it easier for MBA students to enter the finance industry by joining an investment bank. In contrast, buy-side firms – whether a private equity firm or an investment management firm – often do not offer extensive training programs. Instead, they tend to hire MBA job candidates with prior finance experience. Thus, a common MBA career path in finance is to first work at an investment bank before transitioning to a private equity or investment management role.